White Gold Drills 3.98 g/t Au over 32m Near Surface at Golden Saddle and Successfully Defines New High Priority Drill Targets along the Golden Saddle Deposit Trend

September 25, 2017

NOT FOR DISSEMINATION IN THE UNITED STATES OR FOR DISTRIBUTION TO U.S. WIRE SERVICES

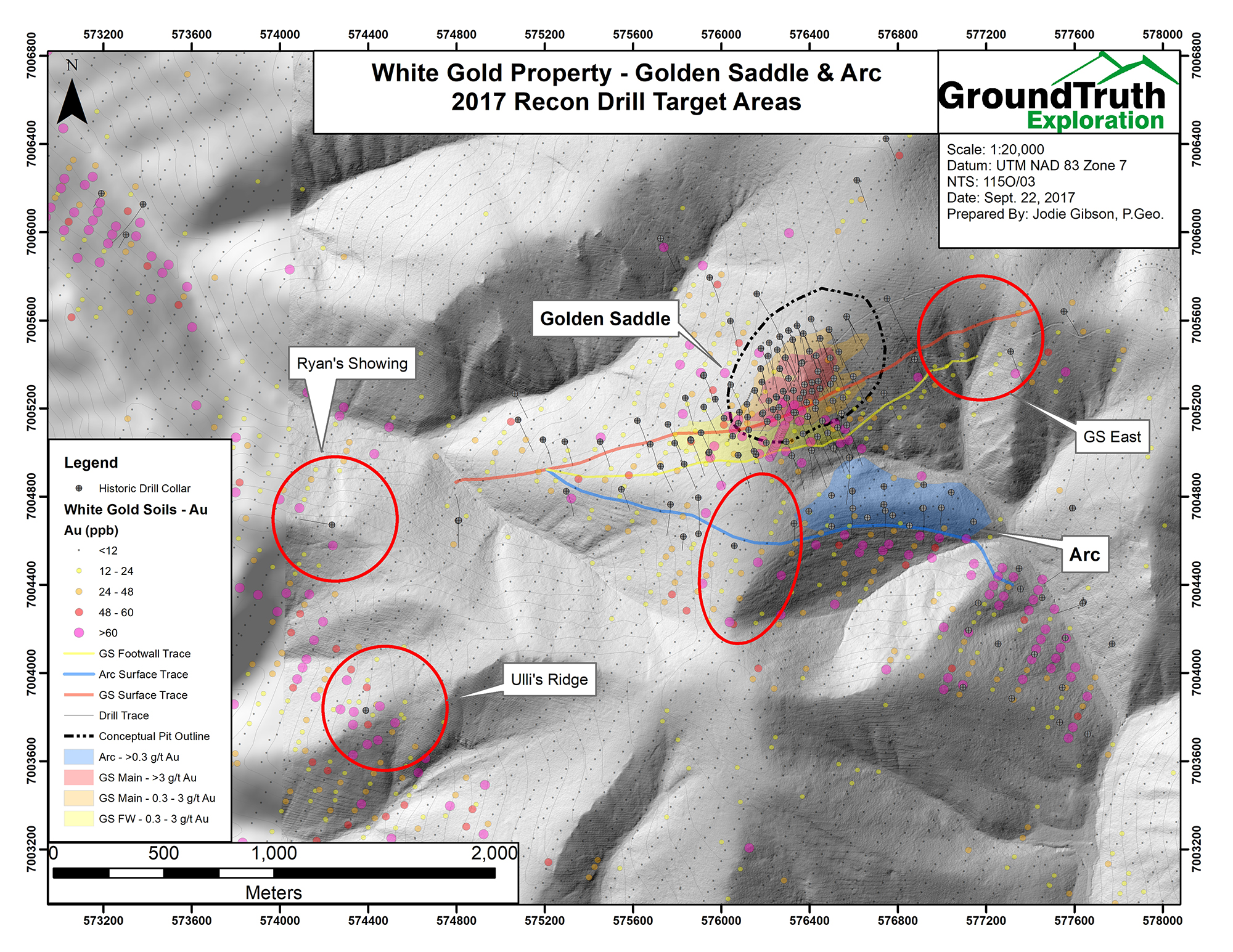

White Gold Corp. (TSX.V: WGO) (the "Company") is pleased to announce the first two reverse circulation (“RC”) drill holes completed on the Golden Saddle deposit, White Gold Property, Yukon. The results of these initial holes are consistent with results from nearby diamond drilling completed by the previous owners and extended the Main Zone at Golden Saddle up-dip towards the surface. The Company is also pleased to announce that its technical team has generated new drill targets from recently completed geophysical surveys on trend with the Golden Saddle deposit, most notably the Golden Saddle East target which is located on strike with the Golden Saddle deposit 600m NE. The Company intends to drill these targets this season. See maps below for further details. The RC and diamond drilling program on the White Gold Property is still underway and additional assay results will be released in due course.

Highlights include:

- Initial Golden Saddle RC drill results return 3.98 g/t Au over 32.004m from 19.812m depth, including 5.51 g/t Au over 21.336m (Hole 17RC-001) and 2.24 g/t Au over 25.908m from 13.716m depth, including 5.36 g/t Au over 9.144m (Hole 17RC-002).

- RC drill results are consistent with nearby diamond drill results thereby validating the use of RC on the White Gold Property and these new results successfully extend the Golden Saddle Main Zone up-dip towards surface.

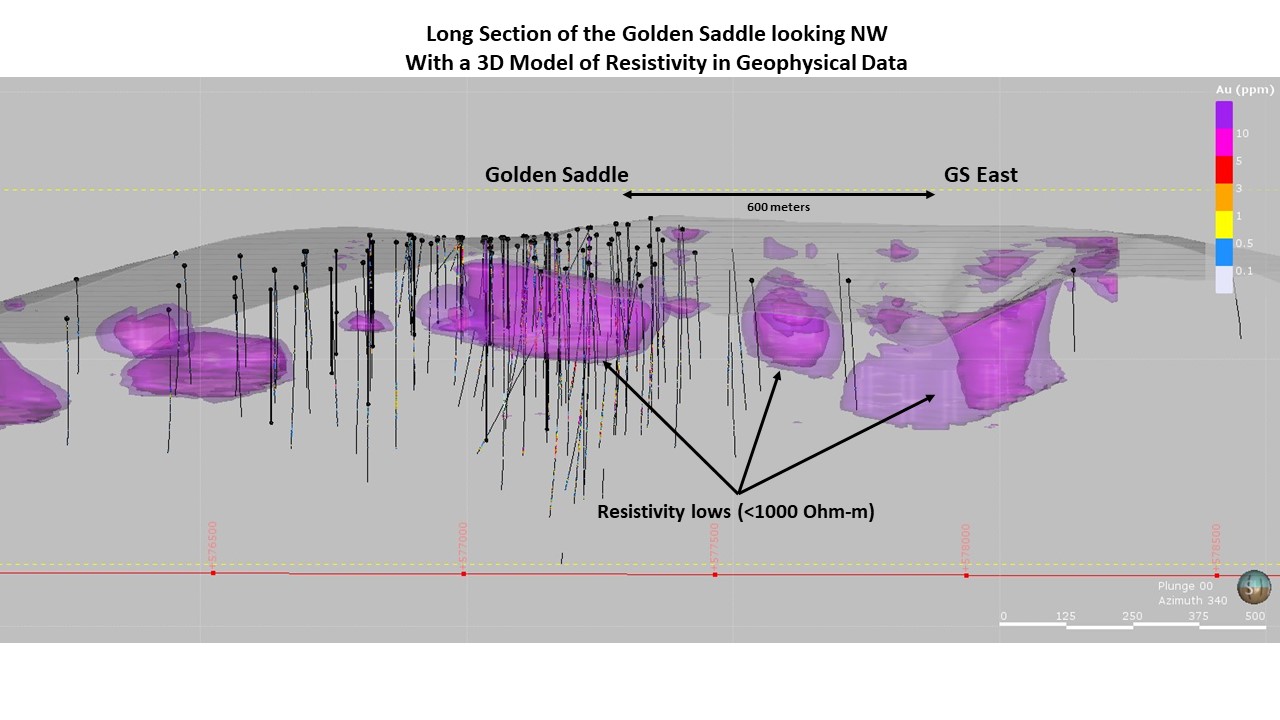

- Recently performed airborne magnetic and DIGHEM electromagnetic and ground resistivity surveys have revealed a significant anomaly located 600m from the Golden Saddle deposit. This target has similar geophysical characteristics as the Golden Saddle, anomalous gold-in-soil anomalies associated with it, and has not been previously drilled. The Company intends to test this anomaly during the 2017 drill season.

- A technical review of data from previous operators has resulted in the identification of the previously undrilled Ulli's Target located 2.2km from Golden Saddle and on trend. This zone is characterized by a gold-in-soil anomaly 860m long by 220m wide with values ranging from trace to 1,117 ppb Au, and historic trench results which are comparable to those that led to the discovery of the Gold Saddle deposit. This target will also be drilled in the 2017 season.

- Drilling is also planned on the Ryan’s Target located 2.1km on trend from the Golden Saddle deposit. This prospect consists of a large gold-in-soil anomaly with values ranging from trace to 1,576 ppb Au, where an isolated historic drill hole in the new priority area intercepted 6.33 g/t Au over 6.56m. The Company intends to test this target during the 2017 drill season.

Golden Saddle Exploration Update

Hole WHTGS17RC-001 returned 3.98 g/t Au over 32.004m from 19.812m depth and included a higher-grade core averaging 5.51 g/t over 21.336 m from 22.86m depth. Multiple intervals of lower grade mineralization were also intercepted at depth within the hole, with the best intercept averaging 1.29 g/t Au over 3.048m from 115.824m depth. The hole was drilled at an azimuth of 160o, dip of -70o, and to a depth of 201.168m. It is located adjacent to historic diamond holes WD-004 and 005, which returned 4.03 g/t Au over 19.58m from 12.99m depth and 4.58 g/t Au over 16.61m from 14.74m depth; respectively1. The purpose of the hole was to twin the historic holes for QA/QC purposes and test for footwall mineralization beneath the extent of the historic drill holes. The RC holes validate the use of RC drilling as an exploration tool on the White Gold Property.

(1) reported in Underworld Resources Inc. (“UW”) news release UW2008 – NR#5 dated July 23, 2008 and available on SEDAR.

Hole WHTGS17RC-002 returned 2.24 g/t Au over 25.908m from 13.716m depth and included a higher-grade core averaging 5.36 g/t Au over 9.144m from 22.86m depth. Multiple zones of quartz-sericite alteration and pyrite mineralization were also intercepted at depth within the hole, with the best intercepts returning 0.513 g/t Au over 24.384m from 120.396m depth, including 1.24 g/t over 7.62m, and 2.30 g/t over 3.048m from 176.784m depth. The hole was drilled 50m to the W-SW of WHTGS17RC-001 at a 160o azimuth, dip of -50o, and to a depth of 201.168m.

The upper intercepts in both holes WHTGS17RC-001 & 002 were in the GS Main Zone and validate RC as an effective drilling method on the Golden Saddle. Additionally, the intercepts infill and demonstrate the continuity of near surface, high grade (>5 g/t Au) mineralization along the southern margin of the deposit area. The deeper intercepts indicate strong continuity of at least three sub-parallel zones below the GS Main Zone. The majority of previous drilling on the Golden Saddle focused on the GS Main Zone and did not adequately test mineralization in the “footwall.” The current interpretation is that higher-grade mineralization occurs within the footwall where the zones intersect structural discontinuities such as fold hinges and lithologic contacts. To aid in the interpretation and targeting, all RC holes are being surveyed using an optical downhole televiewer. The televiewer produces an oriented, high-resolution, digital image down the hole that can be utilized for in-situ structural measurement and interpretation. Analysis of the televiewer data is in progress and will add significantly to the revised geologic interpretation of both the Golden Saddle and Arc.

True thickness is estimated to be between 65 – 95% of the reported intercepts noted above.

To date, 1,970m over 11 RC holes and 837m over 3 diamond holes have been completed on the Golden Saddle and additional assay results are forthcoming. Drilling is still in progress and additional holes are planned on the Golden Saddle and Arc Zones (see the Company’s new release dated Sept. 13, 2017 for more information). Initial drill testing is planned on the Ulli’s, Ryan’s and Golden Saddle East targets and will be discussed in more detail below.

Shawn Ryan, Chief Technical Adviser and a Director of the Company, commented "We are pleased to see the increased grade and continuity in these first holes and are very excited by the discovery and identification of multiple new targets right on trend with the Golden Saddle deposit, identified through the collaboration of our team’s specialized multi discipline technical expertise.”

Exploration on Newly Discovered and other High Priority Targets at White Gold Property

Golden Saddle East Target (“GS East”)

The newly discovered GS East target is located 600m to the NE and on strike of the Golden Saddle deposit. The target was generated through 3D modeling of IP-Resistivity sections and airborne DIGHEM data over the Golden Saddle area. At Golden Saddle, gold mineralization is associated with distinct resistivity and chargeability features that are interpreted to be related to the broader alteration halo of the system. The GS East target has a similar geophysical signature and is associated with anomalous gold in soils at surface. The target area was not tested by historic drill campaigns in on the property, and will be initially tested with drilling in 2017.

Ulli’s Target

The Ulli’s target is located on trend approximately 2.2km SW of the Golden Saddle and consists of an extensive gold in soil anomaly approximately 860m long and 220m wide with values ranging from trace up to 1,117 ppb Au. Trenching2 completed across the area by Kinross Gold Corp. (“Kinross”) in 2012 returned 0.681 g/t Au over 55m from WGUR12TR01, and its extension WGUR12TR03; including 1.38 g/t Au over 20m. These results are comparable to the trenching completed by Underworld Resources Inc. in 2007, on the Golden Saddle deposit which returned a 38 m wide zone of mineralization averaging 1.12g/t Au, including 4.7g/t over 5m and a minimum grade of 0.1g/t over 0.3 m3. Mineralization within the trenches are associated with fractured and brecciated quartzite, quartz veining, and fine-grained sulfide mineralization, and the target has not been previously drill tested. Drill testing in 2017 will follow up on the historic trench results and test the strike extent of the target.

2 Reported in Yukon Assessment Report #096402

3 Reported in UW’s news release UW2008 – NR#5 dated July 23, 2008 and available on SEDAR.

Ryan’s Target

The Ryan’s Target is located on trend 2.1km west of the Golden Saddle and approximately 1km northwest of the Ulli’s target. It is associated with a strong gold in soil anomaly over 500m long with values ranging from trace up to 1,576 ppb Au. Historic exploration on the target was primarily focused on a series of quartz veins at the northwestern end of the target, however, numerous structures cross-cut the area based on recent geologic mapping. The 2017 program will focus on the southeastern end of the target where Kinross had placed an isolated drill hole (WGRS11D0003) that returned 6.33 g/t over 6.56m from 159.44m depth4. Mineralization in the drill hole is associated with strongly brecciated quartzite cut by late quartz veins and pyrite stringers, and appears to be associated with a resistivity low feature based on IP-Resistivity surveys performed by the Company in 2017. The resistivity is projected to come to surface approximately 130m south of the historic drill hole where it is it associated with a distinct E-W linear feature in Lidar imagery and gold in soils up to 1,576 ppb Au. Drill testing in 2017 will follow up on the historic drill intercept and test the interpreted surface trace of mineralization to the south.

4 Reported in Yukon Assessment Report #096402

The Company encourages individuals interested in the Company to visit its website (www.whitegoldcorp.ca) to further understand the size and scope of the Company’s projects in the White Gold District.

The analytical work for the 2017 program has been performed by Bureau Veritas Commodities Canada Ltd., an internationally recognized analytical services provider, at its Vancouver, British Columbia laboratory. Sample preparation was carried out at its Whitehorse, Yukon facility. All soil samples were using procedure SS80 (dry at 60 C and sieve 100g at -80 mesh) and analyzed by method AQ201 (aqua regia digestion and ICP-MS analysis). All rock, GT Probe, RAB, RC, and diamond core samples were prepared using procedure PRP70-250 (crush, split and pulverize 250 g to 200 mesh) and analyzed by method FA430 (30g fire assay with AAS finish) and AQ200 (0.5g, aqua regia digestion and ICP-MS analysis). Samples containing <10g/t Au were reanalyzed using method FA530 (30g Fire Assay with gravimetric finish). Metallic-screen analysis may also be utilized if coarse gold mineralization is encounter (FS600).

Qualified Person

Jodie Gibson, PGeo, of GroundTruth Exploration Inc. is a “qualified person” as defined under National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”), and has reviewed and approved the content of this news release. GroundTruth Exploration Inc. is owned by the spouse of a director of the Company. Potential quantity and grade is conceptual in nature. There has been insufficient exploration to define a mineral resource on any of the Company’s properties to date, and it is uncertain if further exploration will result in any such target being delineated as a mineral resource.

Ground Truth Exploration Inc., Dawson City, YT, designed and managed all work for the Company. The reported work was completed using industry standard procedures, including a quality assurance/quality control (QA/QC) program consisting of the insertion of certified standards, blanks, and field duplicates into the sample stream. The qualified person detected no significant QA/QC issues during review of the data.

About White Gold Corp.

The Company owns a portfolio of 19,438 quartz claims across 30 properties covering over 390,000 hectares representing approximately 40% of the Yukon’s White Gold District. Preliminary exploration work has produced several prospective targets. The claim packages are bordered by sizable gold discoveries owned by Goldcorp Inc. and Western Copper and Gold Corporation. The Company has outlined an aggressive exploration plan to further explore its properties. For more information visit www.whitegoldcorp.ca.

Cautionary Note Regarding Forward Looking Information

This news release contains "forward-looking information" and "forward-looking statements" (collectively, "forward-looking statements") within the meaning of the applicable Canadian securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that involves discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements. In this news release, forward-looking statements relate, among other things, to: the anticipated benefits to the Company and its shareholders respecting the Company’s objectives, goals and exploration activities conducted and proposed to be conducted at the White Gold properties; future growth potential of the Company, including whether any mineral resource will be established in accordance with NI 43-101 at any of the Company’s properties; exploration results; and future exploration plans.

These forward-looking statements are based on reasonable assumptions and estimates of management of the Company at the time such statements were made. Actual future results may differ materially as forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to materially differ from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors, among other things, include: the expected benefits to the Company relating to the exploration conducted and proposed to be conducted at the White Gold properties; failure to identify mineral resources; the preliminary nature of metallurgical test results; uncertainties relating to the availability and costs of financing needed in the future, including to fund any exploration programs on the White Gold properties and the Company’s other properties; business integration risks; fluctuations in general macroeconomic conditions; fluctuations in securities markets; fluctuations in spot and forward prices of gold, silver, base metals or certain other commodities; fluctuations in currency markets (such as the Canadian dollar to United States dollar exchange rate); change in national and local government, legislation, taxation, controls, regulations and political or economic developments; risks and hazards associated with the business of mineral exploration, development and mining (including environmental hazards, industrial accidents, unusual or unexpected formations pressures, cave-ins and flooding); inability to obtain adequate insurance to cover risks and hazards; the presence of laws and regulations that may impose restrictions on mining; employee relations; relationships with and claims by local communities and indigenous populations; availability of increasing costs associated with mining inputs and labour; the speculative nature of mineral exploration and development (including the risks of obtaining necessary licenses, permits and approvals from government authorities); the unlikelihood that properties that are explored are ultimately developed into producing mines; geological factors; actual results of current and future exploration; changes in project parameters as plans continue to be evaluated; soil sampling results being preliminary in nature and are not conclusive evidence of the likelihood of a mineral deposit; title to properties; and those factors described under the heading "Risks and Uncertainties" in the Company’s most recently filed management’s discussion and analysis. Although the forward-looking statements contained in this news release are based upon what management of the Company believes, or believed at the time, to be reasonable assumptions, the Company cannot assure shareholders that actual results will be consistent with such forward-looking statements, as there may be other factors that cause results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking statements and information. There can be no assurance that forward-looking information, or the material factors or assumptions used to develop such forward-looking information, will prove to be accurate. The Company does not undertake any obligations to release publicly any revisions for updating any voluntary forward-looking statements, except as required by applicable securities law.

Neither the TSX Venture Exchange (the “Exchange”) nor its Regulation Services Provider (as that term is defined in the policies of the Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Contact Information:

David D’OnofrioChief Executive Officer

White Gold Corp.

(416) 643-3880

ddonofrio@whitegoldcorp.ca